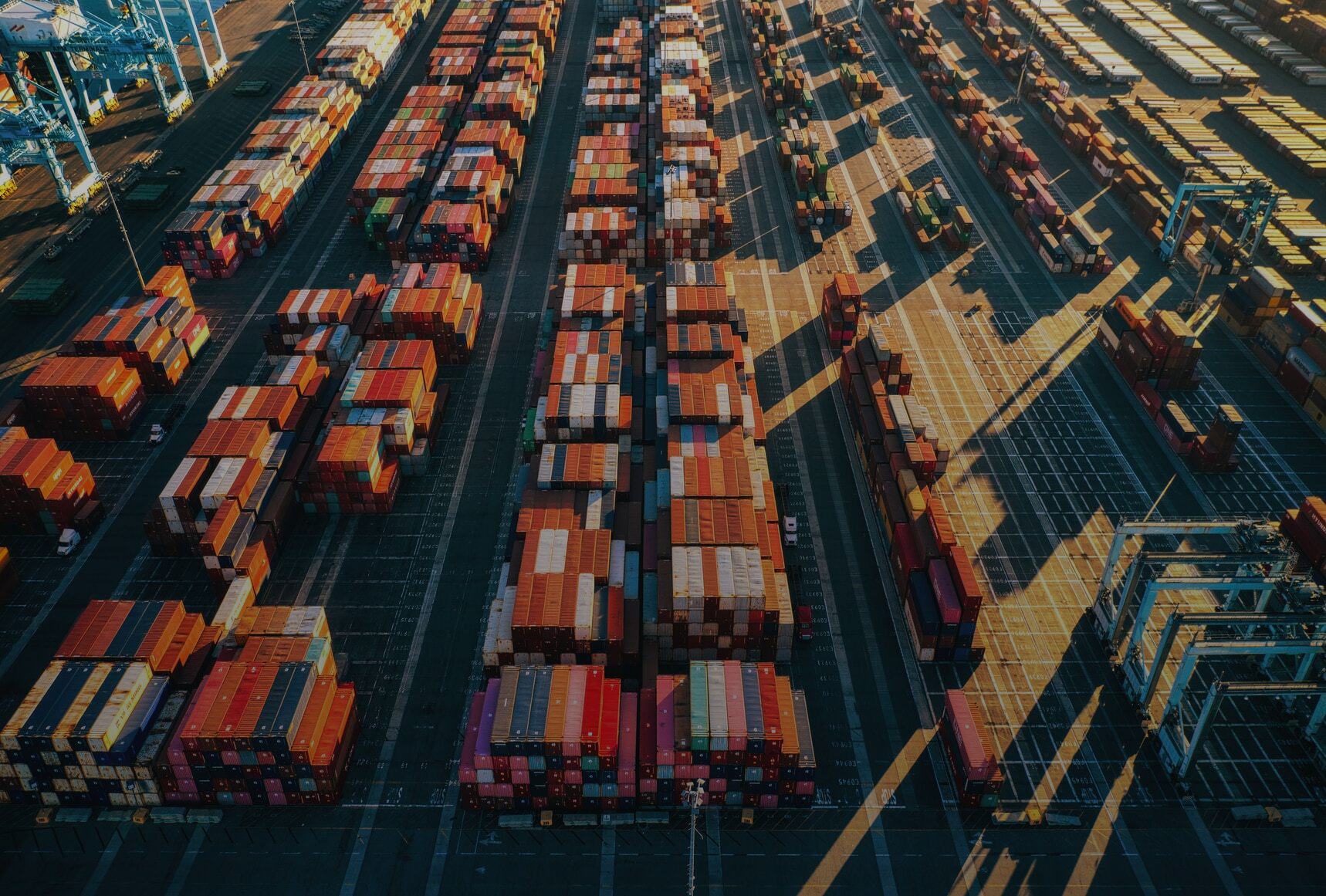

Shipping ports: the need for future solutions

The worldwide shipping crisis is having an enormous impact on the transport of essential goods and raw materials. It is necessary to reconsider the port systems by investing in technological innovation, digitalization and sustainability.

Over the last months the maritime transport crisis has become a crucial issue worldwide, with prices of shipments skyrocketing and a shortage of goods. Ocean-going freight rates have skyrocketed over 460% in the last 12 months. These shipping costs have been impacted by soaring pandemic demand, particularly the promised rapidity and convenience of online shopping, especially with increased automation, rapid delivery firms and micro-fulfillment expansion.

According to Forbes, this has compounded pressure on backed up ports with several weeks’ worth of container ship traffic in port, too few ships, too few dockworkers, a shortage of semiconductors slowing down new truck production, and too few truckers to handle the existing freight. Due to the congestion at ports, millions of consumer products were left stranded, with higher prices which not only have stopped the production of new goods, but caused inflation to rise in several countries.

Picture by K. Mitch Hodge | Unsplash

Based on data from Financial Times, the cost of shipping of a 12 m container from Asia to northern Europe has increased from about $2,0000 to $9,000, while CNBC has reported that the cost of goods transported from Asia to the West Coast of America has increased by 145%. Since July last year, demand for commodities such as medical equipment, home office supplies and computer equipment has forced supply chains to import many products and materials from China to fulfill consumer needs. With the country rebounding from months of suspended trade, this has created an imbalance – exporting approximately three containers for every one imported.

It’s estimated that there are more than 170 million shipping containers across the globe, used to transport around 90% of the world’s goods. This means China doesn’t have enough available containers to meet demand. Reuters claims that “average container turnaround times have ballooned to 100 days from 60 days previously”.

Over the last months the maritime transport crisis has become a crucial issue worldwide, with prices of shipments skyrocketing and a shortage of goods.

To reduce freight costs, many shipowners have started to build bigger cargo ships, known as ultra large container ships (ULCS), which can carry up more than 20,000 containers. Currently, there are 85 ULCS all over the world, 8 still in the works. The problem is that the ports that can receive these vessels are still a few. Neither all ports nor countries can afford the investments needed to improve the existing infrastructures for expanding the docking space and the storage capacity. That is why many shipowners have started to buy companies shares to influence spending decisions and implement the use of ULCS. However, this could hand over the ports management to a few shipping magnates, without solving the congestion problem on long term.

Picture by Jacob Meissner | Unsplash

The shipping crisis confirms the need of reconsidering the ports systems, taking into account not only ships and production means, but the entire supply chain. Last June, an article from The Conversation reported that maritime transport accounts for about 80% of global merchandise trade by volume. Shipping is responsible for 3% of global CO₂ emissions, which have increased 32% the past 20 years.

As we reported here, together with national governments, the European Union is promoting the transition to lower carbon-footprint energy sources – such as liquefied gas, ethanol and green hydrogen – in order to accelerate the industry decarbonization. The energy strategy adopted by port authorities in port cities such as Rotterdam, Antwerp, Hamburg and Le Havre (France) are a great example of how a more sustainable, digitalized and technologically advanced maritime industry is possible. The International Maritime Organization (IMO) envisages GHG emissions from international shipping should be reduced by 50% by 2050. It is still uncertain how this will be achieved, but planning zero-carbon-fuels vessels by 2030 would be a good start.